Welcome to the October review of DivGro, my portfolio of dividend growth stocks. I provide a summary of transactions and dividends received in the past month. I also look at how DivGro's projected annual dividend income (PADI) has changed.

In October, I opened one new position and added shares to three existing positions. Seven DivGro stocks announced dividend increases in October. The net result of these changes is that PADI increased by about 4.0% in October. Year over year, PADI increased by 30.5%.

As for dividend income, in October I received dividends totaling $1,711 from 22 stocks in my portfolio, a year-over-year increase of 42%. So far in 2020, I've collected $23,370 in dividends or about 87% of my 2020 goal of $27,000.

DivGro's PADI now stands at $32,728, which means I can expect to receive $2,727 in dividend income per month, on average, in perpetuity, assuming the status quo is maintained. Of course, I expect the companies I've invested in not only to continue to pay dividends but to increase them over time! Also, until I retire, I hope to continue to reinvesting dividends, so DivGro's PADI should continue to grow through dividend growth and through compounding.

Dividend Income

I received dividends from 22 different stocks, for a monthly total of $1,711 in dividend income:

Here is a list of the dividends I collected in October:

- Automatic Data Processing, Inc (ADP) — income of $63.70

- The Bank of Nova Scotia (BNS) — income of $152.12

- Chubb Limited (CB) — income of $18.72

- Comcast Corporation (CMCSA) — income of $46.00

- Cisco Systems, Inc (CSCO) — income of $108.00

- Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund (ETO) — income of $142.50

- FedEx Corporation (FDX) — income of $48.75

- Illinois Tool Works Inc (ITW) — income of $68.40

- The Coca-Cola Company (KO) — income of $82.00

- Main Street Capital (MAIN) — income of $71.75

- Medtronic plc (MDT) — income of $58.00

- Altria Group, Inc (MO) — income of $172.00

- Merck & Co., Inc (MRK) — income of $67.10

- NIKE, Inc (NKE) — income of $3.68

- Realty Income Corporation (O) — income of $23.40

- Oracle Corporation (ORCL) — income of $42.00

- Philip Morris International Inc (PM) — income of $144.00

- Simon Property Group, Inc (SPG) — income of $130.00

- Stryker Corporation (SYK) — income of $5.75

- Taiwan Semiconductor Manufacturing Company Limited (TSM) — income of $130.51

- W. P. Carey Inc (WPC) — income of $104.40

- Xcel Energy Inc (XEL) — income of $27.95

The chart below shows DivGro's monthly dividends plotted against PMDI. Clearly, quarter-ending months are huge outliers:

For this reason, I now create a rolling 12-month average of dividends received (the orange bars) plotted against a rolling 12-month average of PMDI (the blue, staggered line):

While it would be nicer if dividends were distributed more evenly, it is not something that would drive my investment decisions.

Dividend Changes

In October, the following stocks announced dividend increases or have paid a higher dividend due to exchange rate changes:

- AbbVie Inc (ABBV) — increase of 10.17%

- The Bank of Nova Scotia (BNS) — increase of 0.39%

- Cummins Inc (CMI) — increase of 2.97%

- McDonald's Corporation (MCD) — increase of 3.20%

- NextEra Energy, Inc (NEE) — increase of 0.00%

- Pinnacle West Capital Corporation (PNW) — increase of 6.07%

- Starbucks Corporation (SBUX) — increase of 9.76%

- Taiwan Semiconductor Manufacturing Company Limited (TSM) — increase of 4.64%

As a result of these changes, DivGro's PADI will increase by $181.

I like seeing dividend increases above 7%, and only two of the eight increases top my expectations. The arithmetic average of this month's dividend increases is 4.7%, which still beats inflation.

Transactions

Here is a summary of my transactions in October:

New Position

- Cohen & Steers Infrastructure Fund, Inc (UTF) — new position of 250 shares

- Chubb Limited (CB) — added 76 shares and increased position to 100 shares

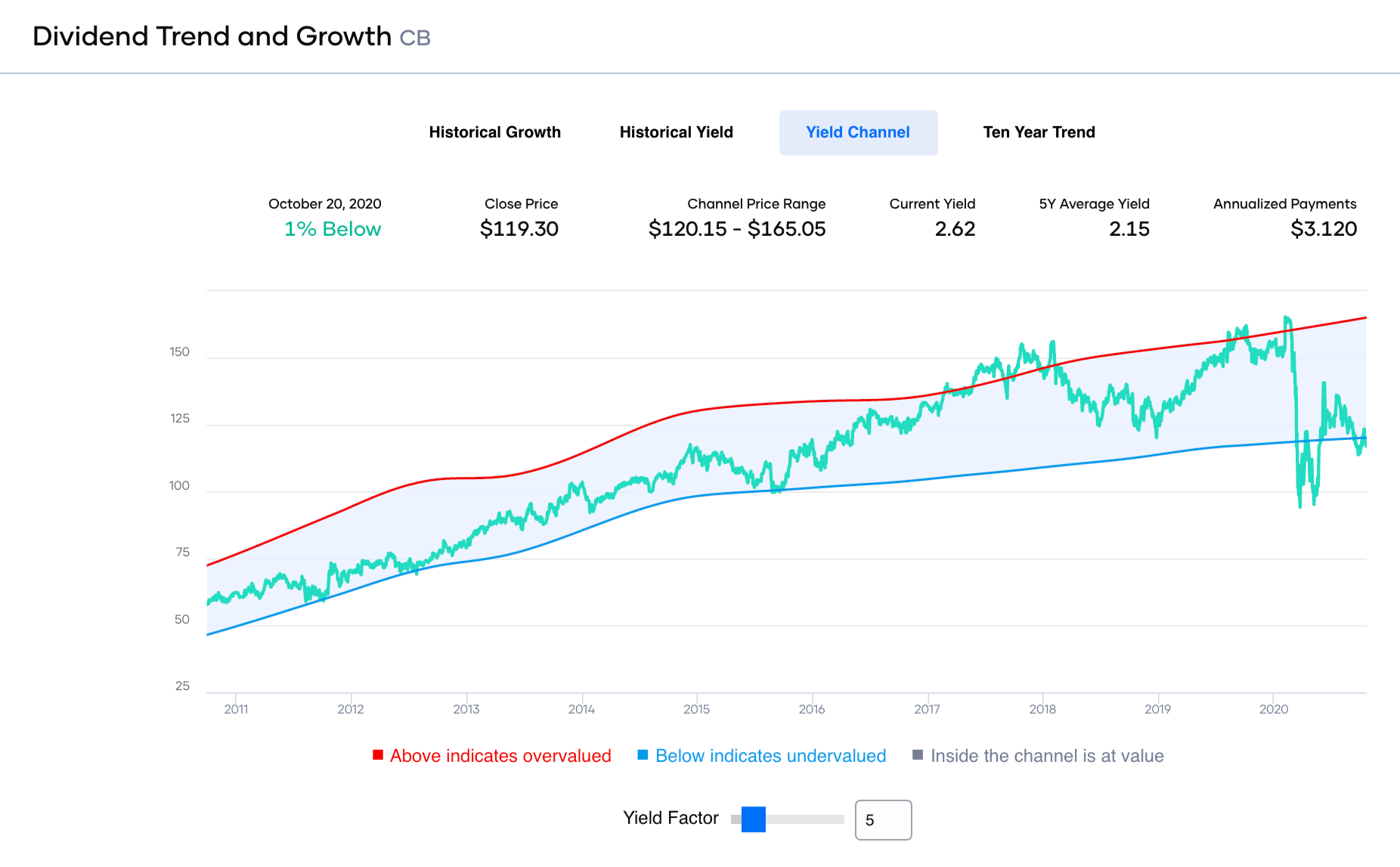

In my recent series on Dividend Aristocrats, I highlighted CB as one of the undervalued Cyclical Sector stocks worth considering. Here is a yield channel chart of CB, showing that the company indeed is trading in undervalued territory, about 1% below the blue undervalued price line of $120.15:

|

Source: Portfolio Insight

I decided to double my CMCSA position. The stock is trading near the undervalued blue line in the following Yield Channel Chart and offers an attractive current yield that is about 10% above its historical 5-year average yield of 1.88%.

Source: Portfolio Insight The 200 shares I added will increase DivGro's PADI by $184. My average cost basis is $38.91 and the average YoC of my CMCSA position is 2.36%. |

With WBA so deeply discounted, I decided to add more shares to my position. WBA is a Defensive Dividend Aristocrat with a very attractive yield, one I feel is too good to pass up!

The following chart shows just how attractive WBA's current yield is compared with its historical 5-year average yield of 2.64%:

|

Source: Portfolio Insight

The 100 shares I added to my WBA position lowered my average cost basis to $55.71 and increased my average yield on cost (YoC) is 3.36%. The addition adds $187 to DivGro's PADI.

Markets

Here is a summary of various market indicators, showing the changes over the last month:

| DOW 30 | S&P 500 | NASDAQ Composite | 10-YR BOND | CBOE VIX | |

| Sep 30, 2020 | 27,781.70 | 3,363.00 | 11,167.51 | 0.677 | 26.37 |

| Oct 31, 2020 | 26,501.60 | 3,269.96 | 10,911.59 | 0.86 | 38.02 |

In October, the DOW 30 dropped 4.6%, the S&P 500 dropped 2.8%, and the NASDAQ dropped 2.3%. The yield on the benchmark 10-year Treasury note rose to 0.86, while CBOE's measure of market volatility, the VIX, increased by 44.2%.

Here's a one-month performance chart of DivGro's dividend growth stocks:

Portfolio Statistics

Given DivGro's current market value and the total capital invested, the portfolio has returned about 59% since inception. But calculating the IRR (internal rate of return) gives a better measure of portfolio performance, as IRR takes into account the timing and size of deposits since inception. DivGro's IRR is 12.8%.

I track the yield on cost (YoC) for individual stocks, as well as an average YoC for my portfolio. DivGro's average YoC increased from 3.66% last month to 3.68% this month.

Percentage payback relates dividend income to the amount of capital invested. DivGro's average percentage payback is 17.5%, up from last month's 17.3%.

Finally, DivGro's projected annual yield is at 4.99%, up from last month's value of 4.83%. I calculate the projected annual yield by dividing PADI ($32,728) by the total amount invested.

Here's a chart showing DivGro's market value breakdown. Dividends are plotted at the base of the chart so we can see them grow over time:

Source: Author's blog (DivGro)

Source: Author's blog (DivGro)Looking Ahead

In October, the market took a bit of a tumble, and my DivGro portfolio wasn't spared. But I'm happy with DivGro's composition although I'm planning to slowly transition my portfolio to one that's a little more defensive.

The following sector chart shows DivGro's current distribution, which is somewhat lightweight in stocks from Defensive Sectors:

Please see my Performance page for various visuals summarizing DivGro's performance.

No comments :

Post a Comment

Please don't include links in comments. I will mark such comments as spam and the comment won't be published. To make me aware of your blog or website, comment on my Blogrole page instead.