I'm behind on writing my monthly reviews because a project at work essentially consumed all available time in the first three months of 2022! I'm hoping to catch up soon!

In February, I executed no buy or sell transactions, choosing instead to continue building my cash reserves. Sixteen DivGro stocks announced dividend increases in February, which resulted in a modest increase of PADI by about 1.4%. Year over year, PADI increased by 14.2%.

As for dividend income, in February I received dividends totaling $2,059 from 24 stocks in my portfolio, a year-over0year decrease of about 4%.

So far in 2022, I've collected $8,082 in dividends, or about 19% of my 2022 goal of $43,200.

DivGro's PADI now stands at $40,199, which means I can expect to receive $3,350 in dividend income per month, on average, in perpetuity, assuming the status quo is maintained. Of course, I expect the companies I've invested in not only to continue to pay dividends but to increase them over time! Also, until I retire, I hope to continue to reinvest dividends, so DivGro's PADI should continue to grow through dividend growth and through compounding.

Dividend Income

In February, I received a total of $2,059 in dividend income from 24 different stocks:

Following is a list of the dividends I collected in February:

- Apple Inc (AAPL) — income of $44.00

- AbbVie Inc (ABBV) — income of $141.00

- Accenture plc (ACN) — income of $9.70

- Virtus AllianzGI Artificial Intelligence & Technology Opportunities Fund (AIO) — income of $60.00

- Air Products and Chemicals, Inc (APD) — income of $24.00

- Bristol-Myers Squibb Company (BMY) — income of $162.00

- BlackRock Science and Technology Trust (BST) — income of $50.00

- Costco Wholesale Corporation (COST) — income of $7.90

- CVS Health Corporation (CVS) — income of $55.00

- D.R. Horton, Inc (DHI) — income of $22.50

- Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund (ETO) — income of $224.00

- Eaton Vance Tax-Advantaged Dividend Income Fund (EVT) — income of $203.25

- General Dynamics Corporation (GD) — income of $119.00

- Hormel Foods Corporation (HRL) — income of $78.00

- Lowe's Companies, Inc (LOW) — income of $80.00

- Mastercard Incorporated (MA) — income of $24.50

- Main Street Capital (MAIN) — income of $55.90

- National Retail Properties, Inc (NNN) — income of $119.25

- Realty Income Corporation (O) — income of $36.98

- The Procter & Gamble Company (PG) — income of $86.98

- Royal Bank of Canada (RY) — income of $139.83

- Starbucks Corporation (SBUX) — income of $68.60

- Texas Instruments Incorporated (TXN) — income of $86.25

- Verizon Communications Inc (VZ) — income of $160.00

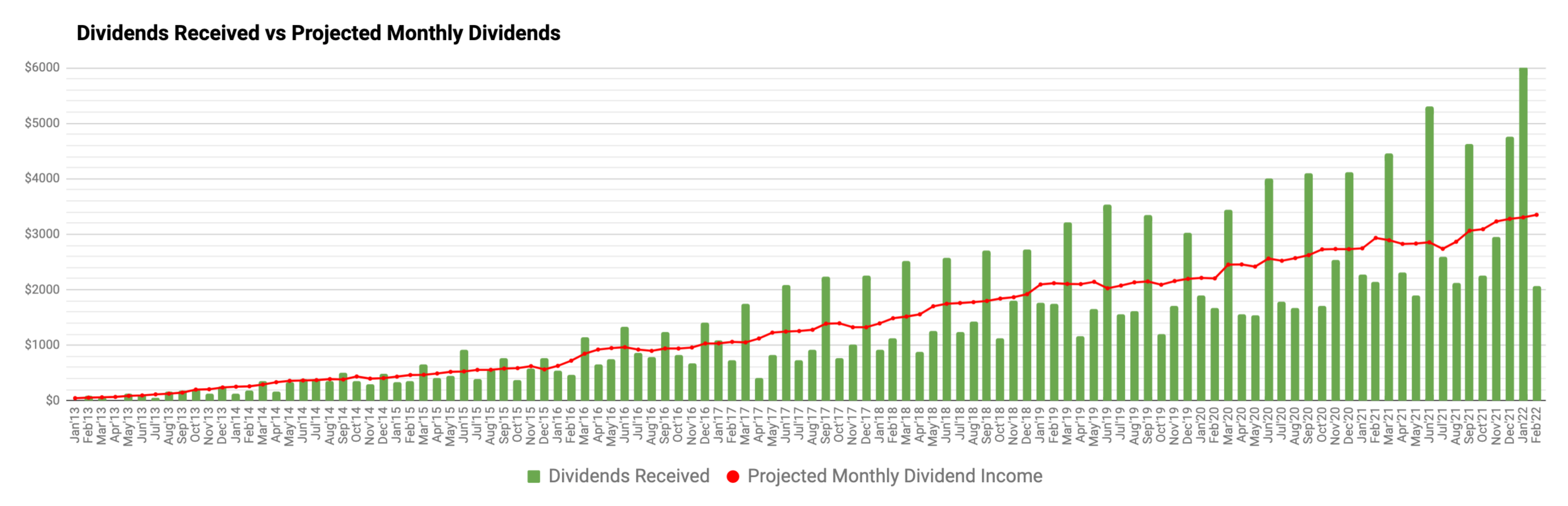

The chart below shows DivGro's monthly dividends plotted against PMDI. Clearly, quarter-ending months are huge outliers:

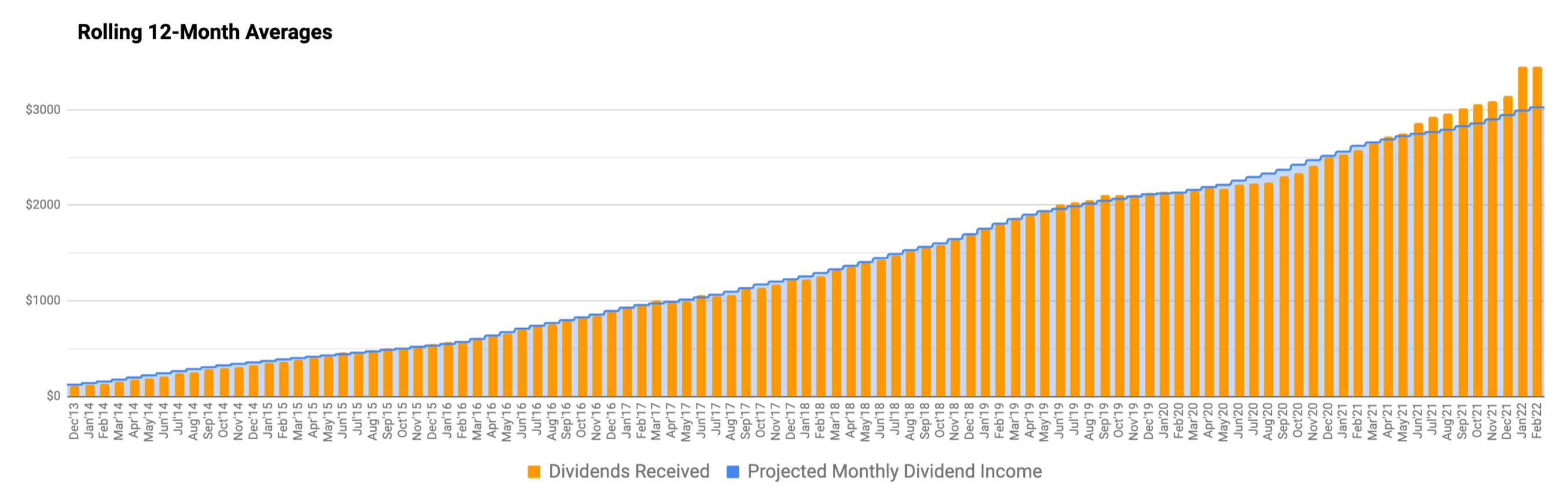

To smooth things out a bit, I create a rolling 12-month average of dividends received (the orange bars) plotted against a rolling 12-month average of PMDI (the blue, staggered line):

While it would be nicer if dividends were distributed more evenly, it is not something that would drive my investment decisions.

Dividend Changes

In February, the following stocks announced dividend increases:

- Virtus AllianzGI Artificial Intelligence & Technology Opportunities Fund (AIO) — increase of 20.00%

- The Allstate Corporation (ALL) — increase of 4.94%

- Air Products and Chemicals, Inc (APD) — increase of 8.00%

- Cisco Systems, Inc (CSCO) — increase of 2.70%

- CVS Health Corporation (CVS) — increase of 10.00%

- Gilead Sciences, Inc (GILD) — increase of 2.82%

- The Home Depot, Inc (HD) — increase of 15.15%

- Intercontinental Exchange, Inc (ICE) — increase of 15.15%

- The Coca-Cola Company (KO) — increase of 4.76%

- 3M Company (MMM) — increase of 0.68%

- Public Service Enterprise Group Incorporated (PEG) — increase of 5.88%

- Royal Bank of Canada (RY) — increase of 9.38%

- Sempra Energy (SRE) — increase of 4.09%

- T Rowe PriceT. Rowe Price Group, Inc (TROW) — increase of 11.11%

- United Parcel Service, Inc (UPS) — increase of 49.02%

- Xcel Energy Inc (XEL) — increase of 6.56%

These changes will increase DivGro's PADI by $553.

I like seeing dividend increases above 7%, and eight of the sixteen increases top my expectations. The arithmetic average of this month's dividend increases is 10.6%, which easily beats inflation.

Transactions

I had no buys or sells in January, choosing instead to build my cash reserves.

In November 2021, I reworked my system for determining target weights for DivGro. The system is dynamic and flexible and allows me to calibrate factors when my goals change. Following is a chart showing the current and target weights of dividend-paying stocks in DivGro:

I'm not really interested in trimming positions to bring them back into "compliance," especially for positions in my taxable account. Rather, I'll favor buying more shares of underweight positions to fill any gaps from below.

I'm continuing my theme of increasing DivGro's exposure to Defensive and Cyclical sectors and, effectively, reducing my exposure to the Sensitive sectors.

Markets

Here is a summary of various market indicators, showing the changes over the last month:

|

DOW 30 |

S&P 500 |

NASDAQ Composite |

10-YR BOND |

CBOE VIX |

|

| Jan 31, 2022 | 35,131.86 | 4,515.55 | 14,239.88 | 1.782 | 24.83 |

| Feb 28, 2022 | 33,892.60 | 4,373.94 | 13,751.40 | 1.839 | 30.15 |

In February, the DOW 30 dropped 3.5%, the S&P 500 dropped 3.1%, and the NASDAQ dropped 3.4%. The yield on the benchmark 10-year Treasury note rose to 1.839%, while CBOE's measure of market volatility, the VIX, increased by 21.4% to 30.15.

Portfolio Statistics

Based on the total capital invested and the portfolio's current market value, DivGro has delivered a simple return of about 128% since inception. In comparison, DivGro's IRR (internal rate of return) is 16.1%. (IRR takes into account the timing and size of deposits since inception, so it is a better measure of portfolio performance).

I track the yield on cost (YoC) for individual stocks, as well as an average YoC for my portfolio. DivGro's average YoC increased from 4.01% last month to 4.06% this month.

Percentage payback relates dividend income to the amount of capital invested. DivGro's average percentage payback is 27.7%, up from last month's 27.4%.

Finally, projected annual yield is calculated by dividing PADI ($40,199) by the total amount invested. DivGro's projected annual yield is at 6.68%, up from last month's value of 6.59%.

The following chart shows DivGro's market value breakdown. Dividends are plotted at the base of the chart so we can see them grow over time:

Looking Ahead

Given the increased volatility in the markets, I'm happy with DivGro's performance! Moving more defensive is bearing fruit and it would be interesting to see how DivGro holds up in the next few months.

I'm hoping to tackle my March and first quarterly reviews in the next week or so.

Please see my Performance page for various visuals summarizing DivGro's performance.

You can now follow me on Twitter and Facebook.

No comments :

Post a Comment

Please don't include links in comments. I will mark such comments as spam and the comment won't be published. To make me aware of your blog or website, comment on my Blogrole page instead.