Welcome to the November review of DivGro, my portfolio of dividend growth stocks. I provide a summary of transactions and dividends received in the past month. I also consider the impact on DivGro's projected annual dividend income (PADI).

In November, I did some portfolio reorganization. The main reason for doing so was to round out my positions, where possible, to multiples of 100 shares. I'm using options trading to boost dividend income, and for covered calls, I prefer having multiples of 100 shares so I can write covered calls on all my shares.

I added shares to 17 existing positions and reduced my investment in one holding. Additionally, I closed five positions, including two closed-end funds (CEFs). Ten DivGro stocks announced dividend increases in November, while four positions were affected by dividend cuts or exchange-rate fluctuations. The net result of these changes is that DivGro's PADI decreased by about 0.1% in November. Year over year, PADI increased by 18.6%.

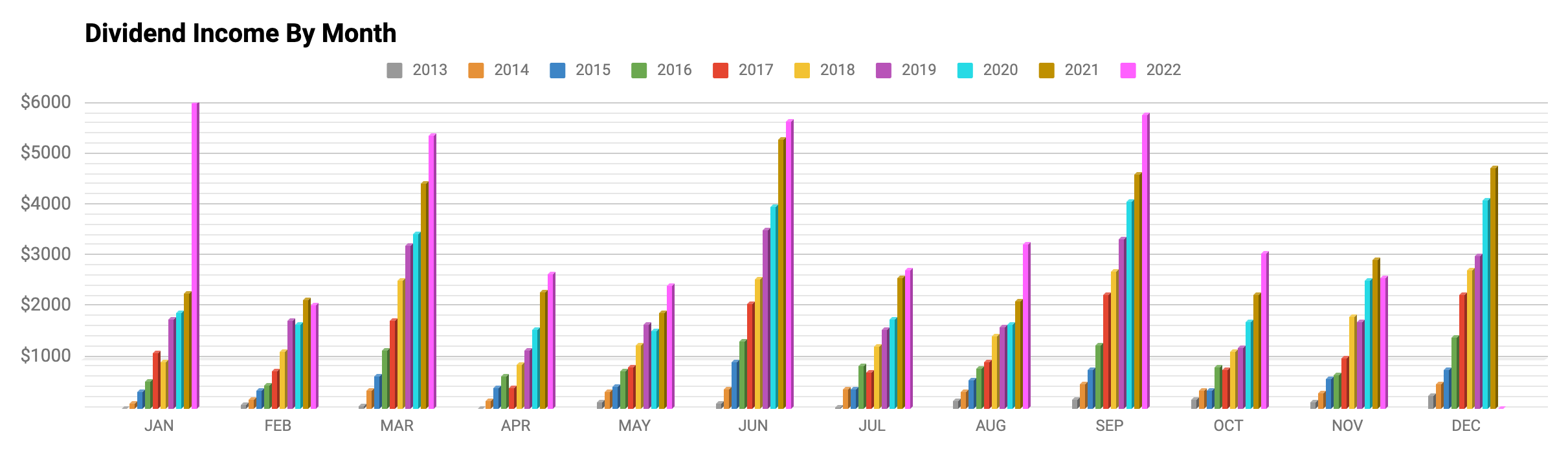

As for dividend income, in November, I received dividends totaling $2,598 from 25 stocks in my portfolio, a year-over-year decrease of 12%. So far in 2022, I've collected $41,718 in dividends, or about 97% of my 2022 goal of $43,200.

DivGro's PADI of $45,972 means I can expect to receive $3,831 in dividend income per month, on average, in perpetuity, assuming the status quo is maintained. But DivGro's PADI should increase over time because I invest in dividend growth stocks. Furthermore, I plan to reinvest dividends until I retire, so DivGro's PADI should continue to grow through dividend growth and through compounding.

Dividend Income

I collected dividends totaling $2,598 from 25 different stocks in November:

- Apple Inc (AAPL) — income of $46.00

- AbbVie Inc (ABBV) — income of $141.00

- Accenture plc (ACN) — income of $11.20

- Virtus Artificial Intelligence & Technology Opportunities Fund (AIO) — income of $180.00

- Air Products and Chemicals, Inc (APD) — income of $25.92

- Bristol-Myers Squibb Company (BMY) — income of $162.00

- BlackRock Science and Technology Trust (BST) — income of $150.00

- Costco Wholesale Corporation (COST) — income of $9.00

- CVS Health Corporation (CVS) — income of $55.00

- Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund (ETO) — income of $171.75

- Eaton Vance Tax-Advantaged Dividend Income Fund (EVT) — income of $186.00

- General Dynamics Corporation (GD) — income of $126.00

- Hormel Foods Corporation (HRL) — income of $78.00

- Lowe's Companies, Inc (LOW) — income of $105.00

- Mastercard Incorporated (MA) — income of $24.50

- Main Street Capital (MAIN) — income of $57.20

- BlackRock MuniHoldings California Quality Fund (MUC) — income of $66.00

- National Retail Properties, Inc (NNN) — income of $110.00

- Realty Income Corporation (O) — income of $37.20

- The Procter & Gamble Company (PG) — income of $91.33

- Royal Bank of Canada (RY) — income of $143.47

- Starbucks Corporation (SBUX) — income of $106.00

- The Toronto-Dominion Bank (TD) — income of $130.37

- Texas Instruments Incorporated (TXN) — income of $124.00

- Verizon Communications Inc (VZ) — income of $261.00

Here is a chart showing DivGro's monthly dividends plotted against PMDI. It is clear that quarter-ending months are huge outliers:

For this reason, I now create a rolling 12-month average of dividends received (the orange bars) plotted against a rolling 12-month average of PMDI (the blue, staggered line):

While it would be great if dividends were distributed more evenly, I don't want to change my investment decisions based on the timing or frequency of dividend payments.

Dividend Changes

In November, the following stocks announced dividend increases:

- Automatic Data Processing, Inc (ADP) — increase of 20.19%

- Aflac Incorporated (AFL) — increase of 5.00%

- Atmos Energy Corporation (ATO) — increase of 8.82%

- DTE Energy Company (DTE) — increase of 7.63%

- Hormel Foods Corporation (HRL) — increase of 5.77%

- Main Street Capital (MAIN) — increase of 2.27%

- Merck & Co., Inc (MRK) — increase of 5.80%

- NIKE, Inc (NKE) — increase of 11.48%

- Snap-on Incorporated (SNA) — increase of 14.08%

- Tyson Foods, Inc (TSN) — increase of 4.35%

I like seeing dividend increases above 7%, and five of this month's ten increases top my expectations.

- Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund (ETO) — decrease of 23.33%

- Eaton Vance Tax-Advantaged Dividend Income Fund (EVT) — decrease of 8.49%

Transactions

Here is a summary of my transactions in November:

Closed Positions

I closed my positions in two of the five CEFs I've owned in 2022:

- Virtus Artificial Intelligence & Technology Opportunities Fund (AIO) — sold all 1,200 shares

- BlackRock Science and Technology Trust (BST) — sold all 600 shares

- American Tower Corporation (AMT) — sold all 50 shares

- 3M Company (MMM) — sold all 75 shares

- Tyson Foods, Inc (TSN) — sold all 200 shares

- BlackRock MuniHoldings California Quality Fund (MUC) — added 1,500 shares and increased position to 3,000 shares

- Virtus Equity & Convertible Income Fund (NIE) — added 750 shares and increased position to 2,000 shares

- The Bank of Nova Scotia (BNS) — added 150 shares and increased position to 300 shares

- Comcast Corporation (CMCSA) — added 50 shares and increased position to 500 shares

- Digital Realty Trust, Inc (DLR) — added 155 shares and increased position to 200 shares

- Intel Corporation (INTC) — added 210 shares and increased position to 490 shares

- Main Street Capital (MAIN) — added 40 shares and increased position to 300 shares

- Medtronic plc (MDT) — added 100 shares and increased position to 200 shares

- Altria Group, Inc (MO) — added 70 shares and increased position to 300 shares

- Realty Income Corporation (O) — added 50 shares and increased position to 200 shares

- Oracle Corporation (ORCL) — added 50 shares and increased position to 200 shares

- Public Service Enterprise Group Incorporated (PEG) — added 50 shares and increased position to 300 shares

- PepsiCo, Inc (PEP) — added 40 shares and increased position to 100 shares

- Union Pacific Corporation (UNP) — added 22 shares and increased position to 70 shares

- United Parcel Service, Inc (UPS) — added 50 shares and increased position to 100 shares

- Verizon Communications Inc (VZ) — added 100 shares and increased position to 500 shares

- WEC Energy Group (WEC) — added 15 shares and increased position to 85 shares

- Amgen Inc (AMGN) — sold 15 shares and reduced position to 100 shares

After this November's transactions, here is chart illustrating the current weight of DivGro positions versus my target weights:

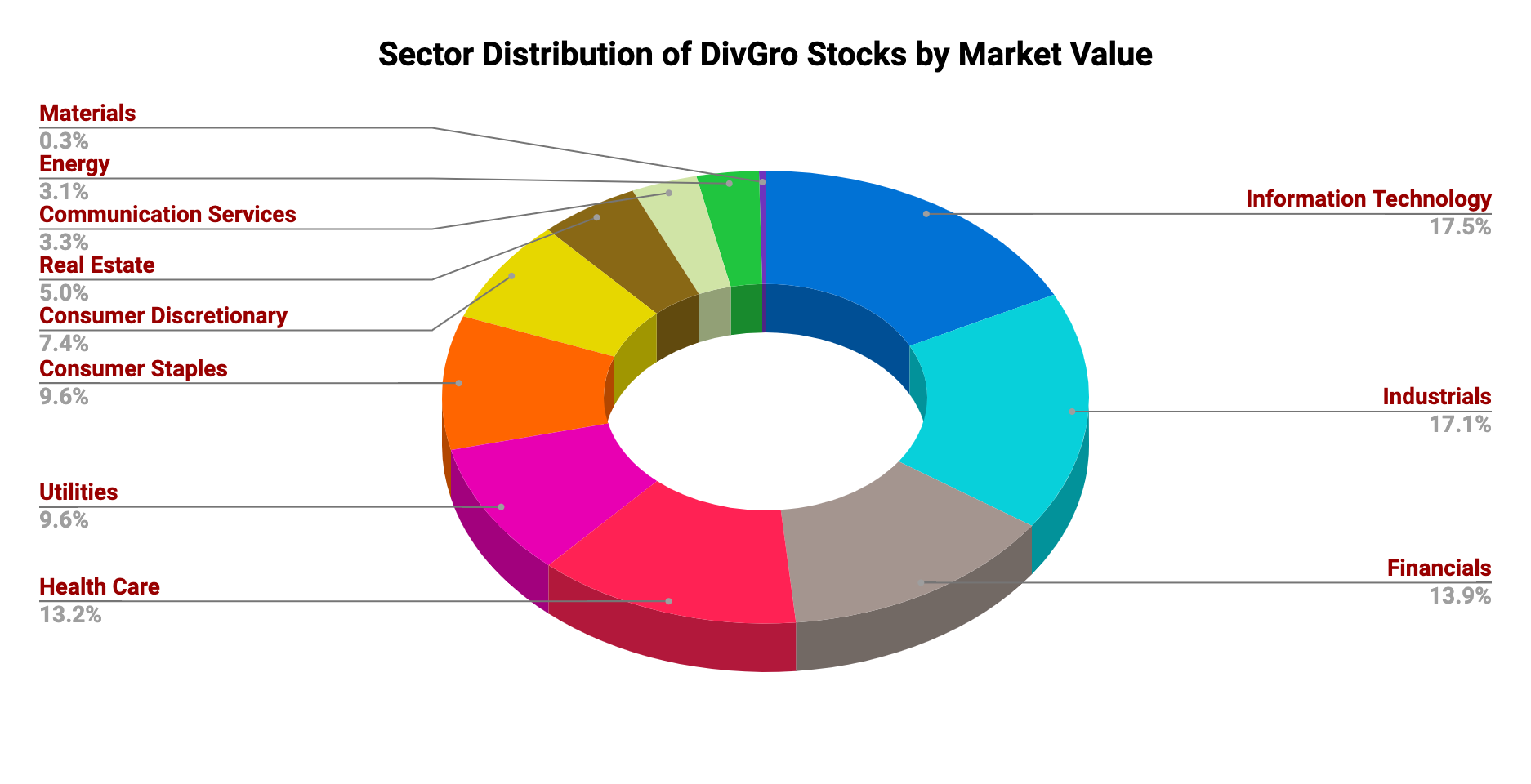

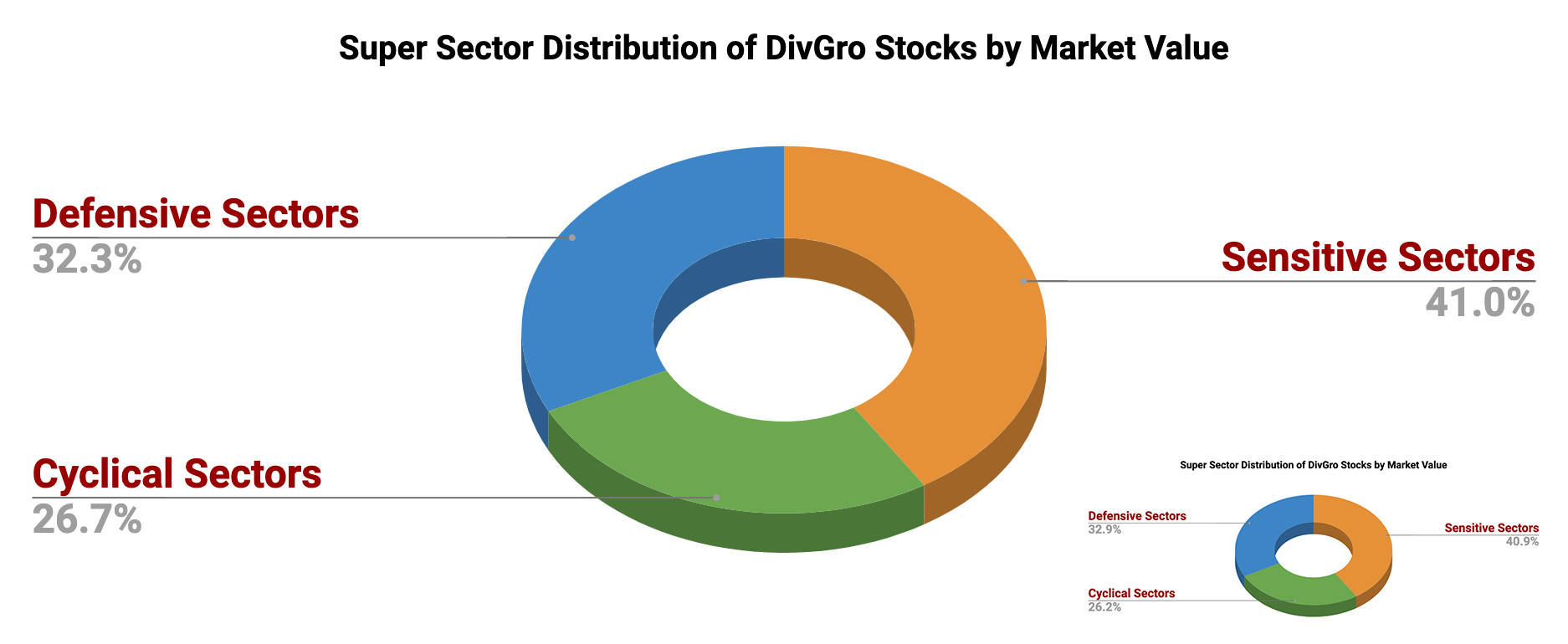

Portfolio Diversification

My exposure to the Defensive sector decreased by 0.6%, whereas my exposure to the Sensitive and Cyclical sectors increased by 0.1% and 0.5%, respectively.

Markets

It is worth looking at the markets to understand the environment we're investing in:

|

DOW 30 |

S&P 500 |

NASDAQ Composite |

10-YR BOND |

CBOE VIX |

|

| Oct 31, 2022 | 32,732.95 | 3,871.98 | 10,988.15 | 4.052 | 25.88 |

| Nov 30, 2022 | 34,589.77 | 4,080.11 | 11,468.00 | 3.703 | 20.58 |

In November, the DOW 30 gained 5.7%, the S&P 500 gained 5.4%, and the NASDAQ gained 4.4%. The yield on the benchmark 10-year Treasury note fell to 3.703, while CBOE's measure of market volatility, the VIX, decreased by 20.5% to 20.58.

Portfolio Statistics

Based on the total capital invested and the portfolio's current market value, DivGro has delivered a simple return of about 122% since inception. In comparison, DivGro's IRR (internal rate of return) is 14.6%. (IRR takes into account the timing and size of deposits since inception, so it is a better measure of portfolio performance).

I track the yield on cost (YoC) of individual stocks, as well as an average YoC for my portfolio. DivGro's average YoC was unchanged from last month's 4.28%.

Percentage payback relates dividend income to the amount of capital invested. DivGro's average percentage payback is 31.1%, unchanged from last month.

Finally, projected annual yield is calculated by dividing PADI ($45,972) by the total amount invested. DivGro's projected annual yield is at 6.94%, down from last month's value of 7.22%.

The following chart shows DivGro's market value breakdown. Dividends are plotted at the base of the chart so we can see them grow over time:

Looking Ahead

I'm looking forward to my break from work over the Christmas season!

December will be the 120th month of DivGro, and in January, I'll celebrate DivGro's 10-year anniversary. I'm unsure if I'll continue blogging about my DivGro portfolio in this current format. I'm looking for new challenges, and I think readers would appreciate a change!

Please see my Performance page for various visuals summarizing DivGro's performance.You can now follow me on Twitter and Facebook.

No comments :

Post a Comment

Please don't include links in comments. I will mark such comments as spam and the comment won't be published. To make me aware of your blog or website, comment on my Blogrole page instead.